March 10, 2023 was a bad day for Silicon Valley Bank customers’ but not as much as it was for the bank. Here is a simplified narrative of what really went down in short bullet points.

Summary

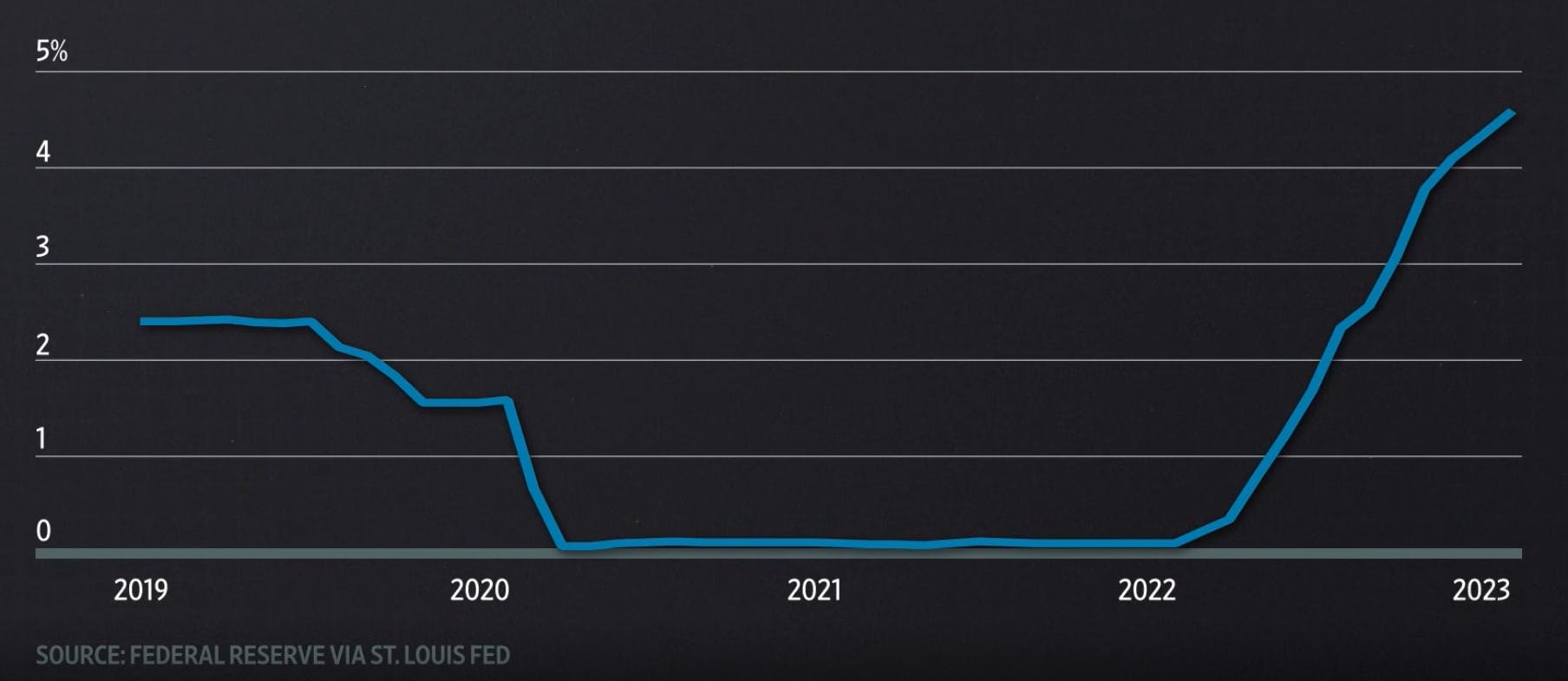

Federal reserves were raising rates.

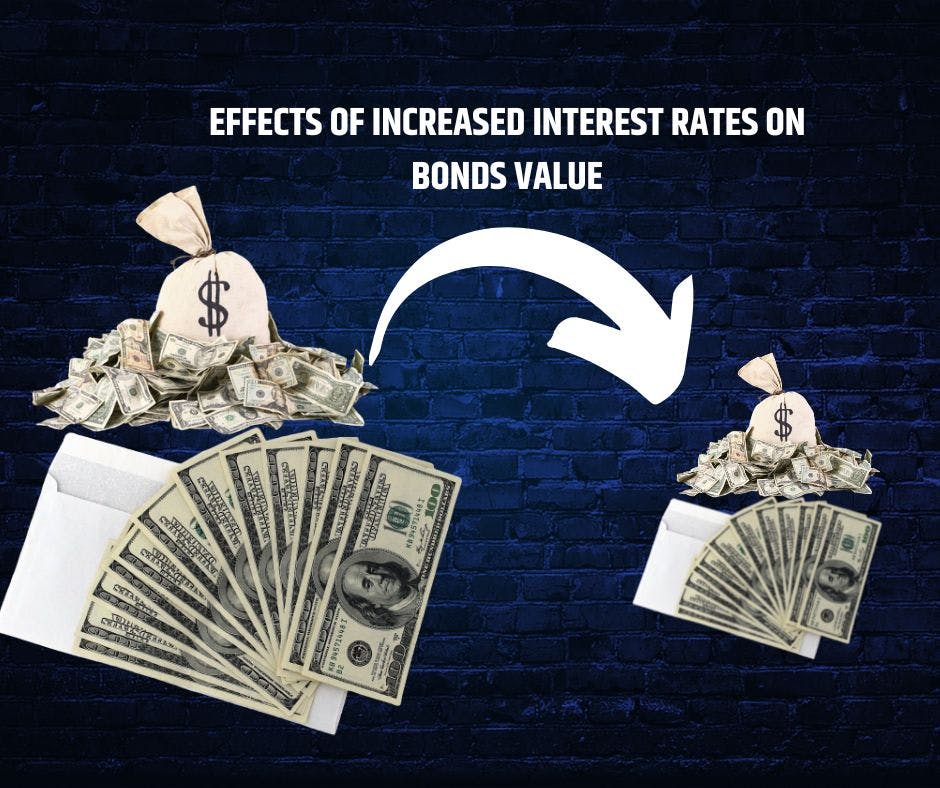

Bonds' value fell.

Deposits were leaving the bank faster than anticipated: people tried to withdraw deposits worth 42 billion in that single day.

They had to sell their bonds at very low rates to meet the withdrawal rate.

Investors freaked out, sold off their stock, and a bank run started.

In Detail,

The Silicon Valley Bank, reckoned as the Tech Startup’s bank, was the 16th largest bank in the United States until its collapse. The collapse is reckoned the second largest bank failure in the US, following the Washington Mutual. SVB’s was a $207 billion worth failure. First, how did they operate, and where did they get capital from?

It opened as a bank that hoped to fund startups, especially in Silicon Valley in Santa Clara, California, where it based. The team shared their visions with investors who liked the idea and pumped in money to fund them. So, their funders were venture capitalists, primarily, and then other business enterprises that trusted them and banked with them.

All was well, as the bank (SVB) invested in long-term stocks and bonds. A way of fixing your financial assets for interest to keep your money or assets' worth safe.

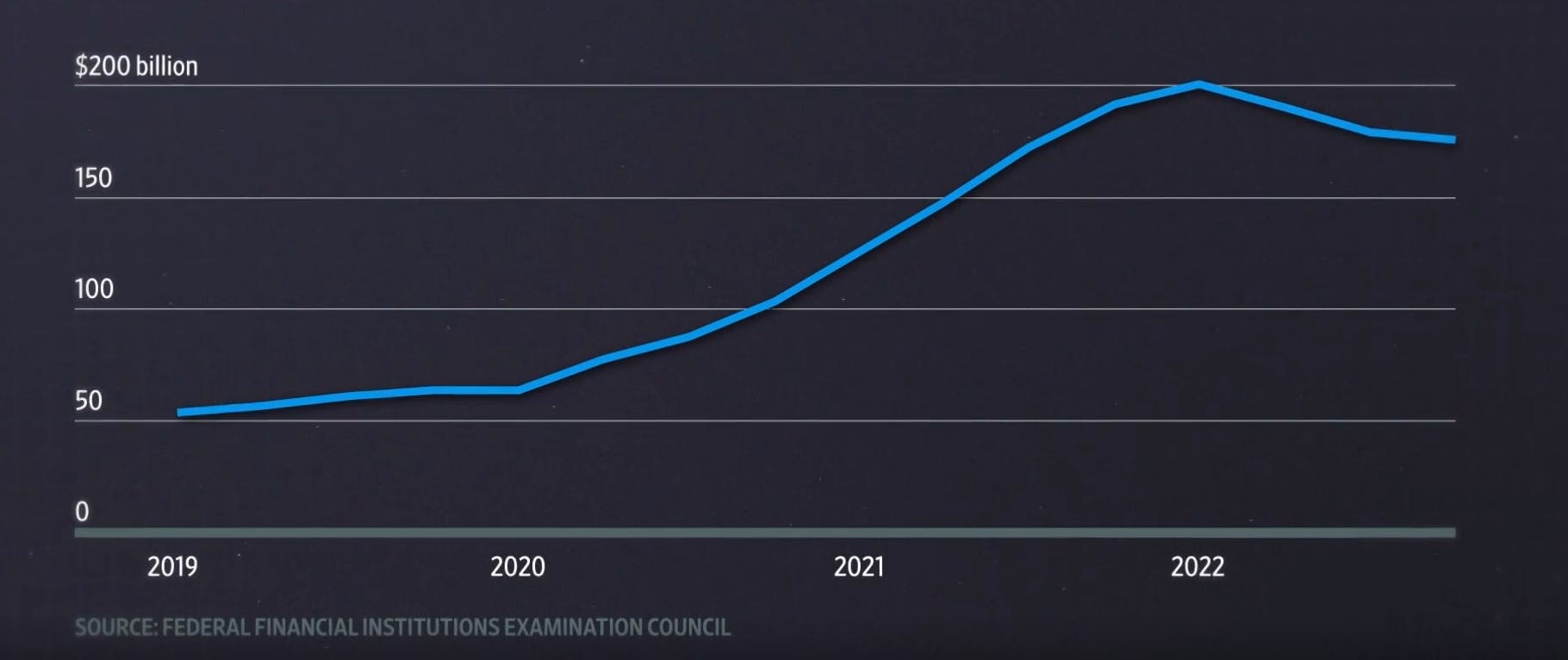

Fortunately for the bank, around 2019—into the mouth of the COVID-19 pandemic—and until 2020, their deposit tripled, and it was a huge influx of customers and money (won't bore you with the numbers). They witnessed growth until 2022. As typical of any bank, they took some deposits and mid-term loans and fixed them by buying financial assets.

SVB’s Bank Deposit

In all of this, their funds were uninsured. They relied on buying securities such as Treasuries and bonds, which keep their money safe and can raise its value. However, the problem with fixing money in bonds is that you'll be in trouble if you have to sell off the bonds under pressure. But who would hope for such calamity for a reputable bank in the country’s tech center?

Selling Under Pressure

For instance, if you need money urgently and do not have liquid cash, you may have to sell off some of your properties at a very ridiculous price just to raise quick money. But as long as you do not need some quick or emergency money, you are good.

Some federal regulations were happening, and the Federal Reserve was raising interest rates to control inflation (large volume of money in circulation causing a drop in the currency’s value). And as the rates climbed, the bonds that SVB invested in reduced in value.

U.S. Federal Funds Interest Rate

Somehow, around that time, the deposits began to occur more rapidly. People and businesses were withdrawing their money for whatever reasons, including the awareness that the bonds in which SVB invested had depreciated and regular business needs. Of course, before the unfortunate incident of March 10, the deposits in the bank had decreased from the peak since 2022 (to the bank, it is a deposit; to customers and partners, you'd call it a withdrawal). That was not an issue, though; sometimes deposits grow, and other times they are low. It is common for banks.

The problem was that the withdrawals were too sudden now, and different customers of the bank tried to withdraw an amount of about 42 billion in just one day! ...and growing. To meet its customers' needs, SVB had to sell off its bonds at ridiculous prices, which incurred a loss.

They spoke with investors and promised to raise more capital the following day; unfortunately, the investors would not have it. They withdrew their support, dissolving the bank as salt would in water.

They have not been able to meet all their customers' needs. Companies that use the bank to payroll their staff were stranded on Friday, March 10.

Implications?

The implications are more far-reaching, economically and financially. It affected the entire banking industry, as investors in other banks also raised their concerns, wondering if the banks were insured by the Federal Reserve or some other means. Such banks include First Republic, Signature Bank and Pacific Western Bank. Signature Bank had been seized by the ‘government’ just to protect people’s money and hinder the industry-wide panic that can cause people to mass-withdraw, which can hurt the bank, investors, and depositors. Just that this time, only the bank would be affected. Hence, the Signature Bank being seized by the government with $118 billion funds becomes the third US largest bank failure.

Contributors to the Bank's Collapse

Different factors contributed to Silicon Valley Bank's collapse, not just one thing. They include

Uninsured funds

Federal regulations and control of interest rates and economic markets

Social Media with the large power to move information around, even when unclear or some truth is missing

The humans who use and give social media the power it has.